If Your Child’s Future Is Your Priority, This Could Be Helpful

Unlock powerful strategies today to shape a brighter path for the next generation.

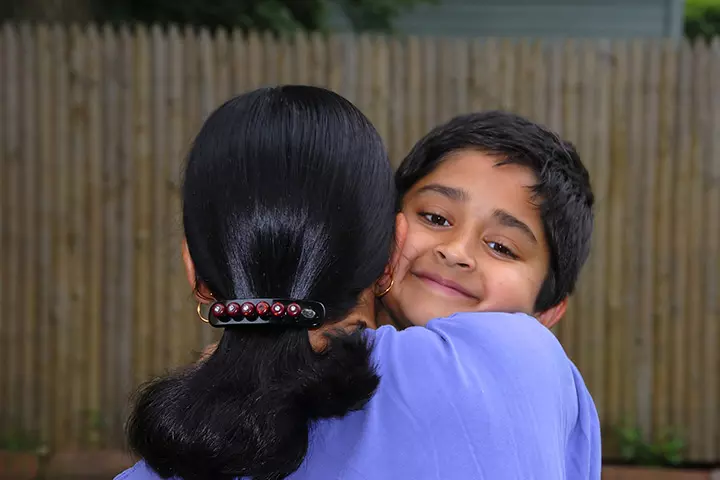

Image: Shutterstock

“We can’t buy this now, probably next month.” I grew up hearing this a lot. Often in response to demands which were termed frivolous. Whether it was to go on a field trip or to buy a basketball. If I couldn’t establish a clear connection between my demand and my education, it was quickly dismissed as frivolous by my parents.

So, while I had a perfectly comfortable childhood, I couldn’t help but wonder what I could’ve achieved had I been allowed to pursue those so-called non-academic interests. This had always been at the back of my mind, and when I became a mother myself, it became the core of my approach to parenting.

I was a fairly responsible woman in my early twenties. I had a decent salary, which allowed me to pay my bills on time. I had even opened an RD account and had saved up some money. I thought I was doing good. But then I got married and my expenses went up. Still, my husband and I were able to live comfortably. All that changed when I conceived my son, Aarush. The stark reality of our barely-there financial planning hit me hard. I didn’t want history to repeat itself. So, I took it upon myself to do something about it. Finally, when Aarush was six-months-old, my husband and I had a serious discussion about our financial condition. We both realized that we didn’t want money to come in the way of our son’s future. Let’s say for example a simple swimming class charges Rs. 45000 yearly or a tennis class charges Rs. 35000. If you cumulate 3-4 co-curricular activities, you will soon realize in between taking care of their education and co-curricular activities, you are hardly able to save enough for his future. So, at the end of every month, I thought with the little savings how I could give every opportunity to our little one.

The question remained how. In terms of money, we were still cutting it pretty close, so there was no way we could invest in a sizeable amount of money right away. Hence, we started looking at plans that would help us invest a little amount every month towards our child’s future. After much searching and online browsing, we chanced upon an insurance cum investment plan offered by ICICI Prudential Life, called, ICICI Pru Smart Life. This plan offered dual benefits of insurance and investment and allowed us to grow our money on our terms. In this age of competition, we never know when my child will require money. He might choose to pursue his passion at any age; he might choose to go for his higher education to his choice of country. Hence, money might be required at any point in time and this was one thing I loved about this plan. It provided flexibility in terms of payout options. So, at whatever point my little one requires money to fulfill his dreams we as parents will be there.

Today, it has been four years since we first invested in the plan. And over all these years, we have watched our initial fund grow substantially due to the many added benefits offered by the plan. As I plan to enroll Aarush in preschool, I can finally breathe a sigh of relief. We now have a security net to fall back on. I know that if there is an emergency, I could still access that kitty of money that we kept aside for Aarush, for the plan also offers us the choice to make partial withdrawals. A plan that grows my money and gives me access to it as well? What more could I want?

But wait, I never told you why I don’t have a single line of worry on my forehead regarding my son’s future. In case something was to happen to us, the policy offers to cover our future payments to ensure that we are still able to meet our financial goals. And that has assured me that even if I am not there, Aarush will get every opportunity to become the man he wants to be.

As a mother, this plan has given me a lot of comfort. I can genuinely say that opting for it has been a step in the right direction. I would love to know how you plan for your child’s future.